Why China’s Power Electronics Industry is Replacing Silicon IGBTs with Domestic SiC Power Modules

China is shifting as Chinese SiC power modules replace imported IGBT modules, delivering higher efficiency, lower BOM cost, and supply chain security for EVs.

China’s power electronics industry is undergoing a profound structural transformation. R&D and supply chain departments have reached a critical consensus: the comprehensive replacement of imported silicon-based IGBT (Insulated Gate Bipolar Transistor) modules with Chinese silicon carbide (SiC) power modules is not merely a technological evolution—it represents a strategic imperative for supply chain security and industrial survival.

This consensus stems from the convergence of four powerful forces: physical limitations of silicon technology, system-level commercial value creation, escalating geopolitical risks, and supportive national industrial policies.

Analysis reveals that SiC’s wide bandgap characteristics not only overcome the physical bottlenecks of silicon devices in 800V high-voltage platforms and high-frequency applications but also fundamentally reshape the Bill of Materials (BOM) economics for new energy vehicles and industrial equipment through dramatically improved power density and efficiency. Meanwhile, facing increasingly severe international semiconductor equipment and technology restrictions, localization has evolved beyond cost considerations to become a baseline requirement for enterprise risk management.

With explosive growth in Chinese SiC substrate capacity driving upstream costs down significantly, combined with breakthrough achievements in device reliability (such as the application of Si₃N₄ AMB substrates), Chinese SiC has established the material foundation to progress from “replacement” to “surpassing” international competitors.

Chapter 1: Technical Logic—Breaking Physical Limits and Reconstructing System Efficiency

1.1 The Physics Advantage of Wide Bandgap Materials

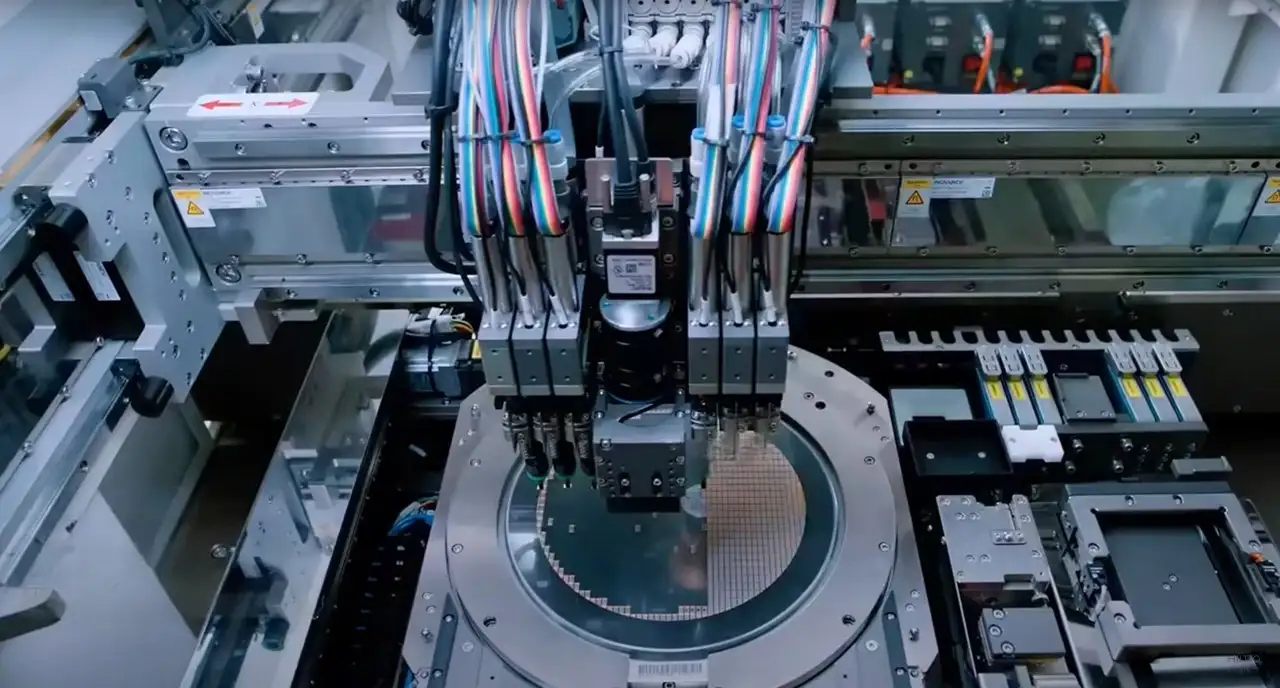

The fundamental reason R&D departments are driving the replacement of imported IGBT modules with Chinese SiC modules lies in silicon’s approaching physical performance limits, which cannot satisfy future power electronics systems’ demands for higher efficiency, power density, and operating frequency. As a third-generation wide bandgap semiconductor, SiC delivers disruptive technical advantages through its inherent physical properties.

Core Physical Parameters:

SiC features a bandgap of 3.26 eV—nearly three times wider than silicon’s 1.12 eV. This fundamental physical difference yields three critical technical advantages:

- 10× Higher Breakdown Electric Field Strength: For equivalent voltage ratings (e.g., 1200V), SiC devices require thinner drift regions with higher doping concentrations. This directly translates to dramatically reduced on-resistance (R_DS(on)), significantly minimizing conduction losses.

- 2× Faster Electron Saturation Drift Velocity: This enables SiC devices to switch at extremely high frequencies, reducing switching energy losses while—more importantly—allowing the use of substantially smaller passive components (inductors, capacitors, transformers).

- 3× Higher Thermal Conductivity: With thermal conductivity approaching that of copper, SiC dramatically improves device heat dissipation. This means reduced cooling system requirements for the same output power, or alternatively, higher power output under identical cooling conditions.

1.2 Deep Analysis of Conduction and Switching Losses

In practical circuit applications, IGBTs and SiC MOSFETs exhibit fundamentally different loss mechanisms.

1.2.1 Conduction Characteristics Comparison

- IGBT (Bipolar Device): IGBTs inherently exhibit a threshold voltage (V_CE(sat)) during conduction, typically 1.5V to 2.0V. This voltage drop persists regardless of current magnitude, meaning efficiency degrades significantly under light-load conditions (e.g., electric buses during low-speed urban driving).

- SiC MOSFET (Unipolar Device): SiC MOSFETs demonstrate pure resistive characteristics (R_DS(on)) without threshold voltage. Conduction voltage drop scales linearly with current (V_DS = I_D × R_DS(on)). Under most real-world operating conditions (medium to light loads), SiC’s conduction voltage drop remains substantially lower than IGBTs, achieving superior efficiency across the entire operating envelope.

Supporting Data:

Consider BASiC Semiconductor’s BMF540R12MZA3 (1200V/540A) module: its typical R_DS(on) at 25°C measures only 2.2 mΩ. Even at 175°C, elevated temperatures, measured resistance increases only to approximately 5.03 mΩ (upper bridge arm data). This low-resistance characteristic ensures minimal conduction losses in high-voltage, high-current applications—performance that traditional IGBTs of equivalent ratings cannot approach.

1.2.2 Revolutionary Reduction in Switching Losses

- IGBT Tail Current: During IGBT turn-off, minority carriers accumulated in the drift region require time to recombine and dissipate, preventing instantaneous current cutoff and creating “tail current.” This current continues flowing under high voltage, generating substantial turn-off losses (E_off) and limiting IGBT switching frequencies to typically below 20 kHz.

- SiC Zero-Tail Characteristics: As unipolar devices, SiC MOSFETs eliminate minority carrier storage effects, thus producing no tail current. Turn-off speed is extremely rapid, limited primarily by gate drive and parasitic capacitance.

- Reverse Recovery Losses: Traditional IGBT modules typically employ anti-parallel fast recovery diodes (FRDs) with substantial reverse recovery charge (Q_rr), causing significant losses and electromagnetic interference (EMI) during turn-on transients. SiC MOSFETs utilize intrinsic body diodes or parallel SiC Schottky barrier diodes (SBDs) with minimal Q_rr.

Simulation Comparison:

In H-bridge topology simulations for high-end industrial welding equipment, BASiC Semiconductor’s 34mm SiC module compared against a leading international brand’s high-speed IGBT module demonstrated: even with SiC switching frequency increased to 80 kHz (versus IGBT’s 20 kHz), total losses (239.84W) remained substantially lower than IGBT (596.6W), improving overall efficiency from 97.10% to 98.82%. This phenomenon of “quadrupling frequency while halving losses” provides the most compelling evidence for SiC’s technical advantages.

1.3 System-Level Benefits from Frequency Elevation

The technical logic culminates not in the device itself but in system-level optimization. SiC’s high-frequency capability triggers a cascade of benefits:

- Magnetic Component Miniaturization: According to transformer and inductor physics, higher frequencies enable proportionally smaller magnetic core volumes and fewer winding turns. In welding machines and photovoltaic inverters, this translates to substantial savings in copper and magnetic core materials, directly reducing BOM costs.

- Enhanced Control Bandwidth: Higher switching frequencies enable faster current loop control response—critical for high-precision servo drives and high-performance motor control, significantly improving machining accuracy and dynamic response capabilities.

Chapter 2: Commercial Logic—System Cost Reduction and Market Competitiveness Transformation

While Chinese SiC power modules currently command price premiums over equivalent imported IGBT modules (typically 1.2-1.5× higher), supply chain departments calculate meticulously: they focus on Total System Cost reduction and enhanced end-product competitiveness.

2.1 “Pay More, Spend Less” System BOM Economics

The commercial logic core: Increase semiconductor investment to achieve savings on other expensive components.

- Thermal Management Simplification: SiC’s superior efficiency reduces heat generation, while its high-temperature tolerance (junction temperature T_vj reaching 175°C or higher) permits elevated coolant temperatures. This enables smaller, lighter heat sinks—or even transitioning from liquid to air cooling in certain applications—reducing mechanical system costs and weight.

- Passive Component Cost Reduction: As discussed, high-frequency operation enables volume reduction in inductors and capacitors, directly decreasing consumption of bulk materials like copper and aluminum, reducing PCB area and enclosure size, thereby lowering logistics and warehousing costs.

2.2 Energy Storage and Charging Efficiency: Commercial Necessity

As energy storage and charging applications pursue efficiency improvements alongside increasingly stringent national standards:

- IGBT Limitations: Traditional 1200V silicon IGBTs experience rapidly escalating conduction and switching losses, struggling to meet efficiency requirements.

- SiC Dominance: 1200V SiC MOSFETs operate precisely within their performance sweet spot, perfectly balancing high voltage ratings with low losses.

2.3 Localization-Driven Cost Avalanche

Another critical commercial driver for supply chain departments pushing Chinese replacement: leveraging domestic overcapacity to force cost reductions.

- Substrate Price War: Throughout 2024, China’s SiC substrate industry experienced dramatic capacity expansion, triggering price collapse. Mainstream 6-inch SiC substrate prices plummeted nearly 50%. This upstream raw material “price war” substantially reduced BOM costs for downstream Chinese module manufacturers, creating enormous price advantages versus imported products.

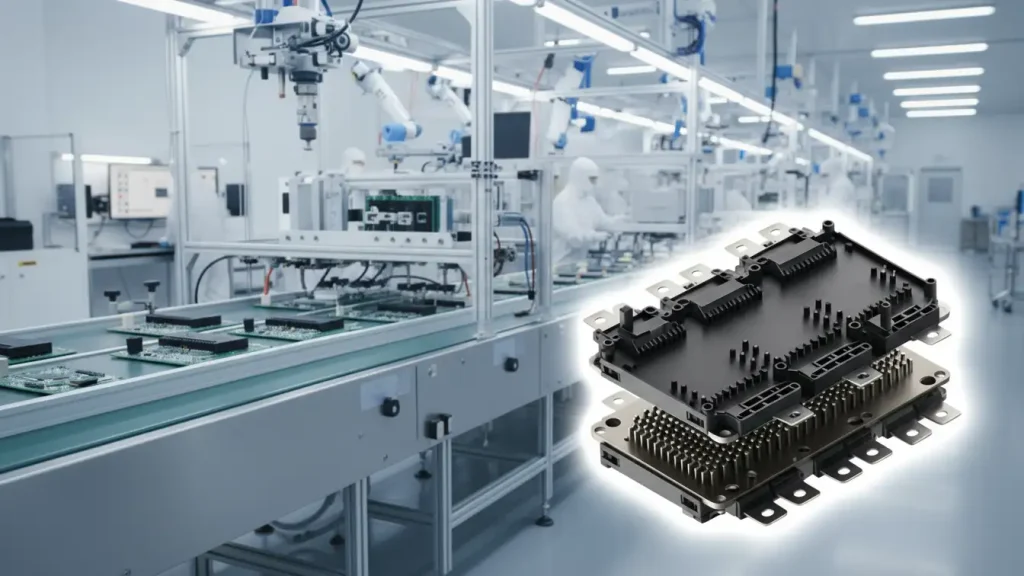

- Vertical Integration Advantages: IDM manufacturers like BASiC Semiconductor, along with deep involvement from power electronics system manufacturers, have integrated value chains spanning solid-state transformers (SST), energy storage converters (PCS), industrial and commercial energy storage PCS, grid-forming energy storage PCS, centralized large-scale storage PCS, commercial vehicle electric drives, mining vehicle electric drives, wind power converters, and data center HVDC systems—from materials through end applications. This vertical integration model eliminates intermediary markups, giving Chinese SiC the potential for “hand-to-hand combat” with imported IGBT modules on cost.

Chapter 3: Product Maturity and Reliability—Breaking the “Unusable” Prejudice

Historically, the greatest skepticism facing Chinese modules centered on “reliability” and “consistency.” However, the latest technical developments demonstrate that this shortcoming is being rapidly addressed, with certain packaging technologies even achieving superiority.

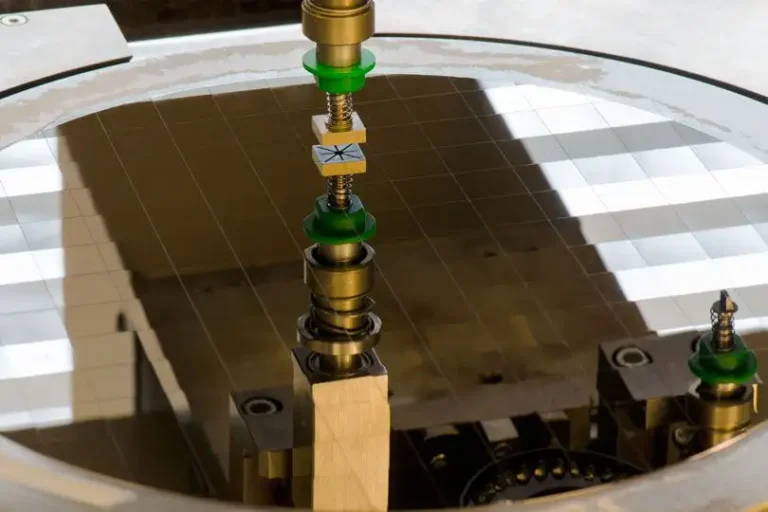

3.1 Packaging Material Innovation: Si₃N₄ AMB Substrates

To accommodate SiC’s high-temperature, high-power-density characteristics, Chinese module manufacturers (such as BASiC Semiconductor) have implemented bold packaging innovations, adopting silicon nitride (Si₃N₄) Active Metal Brazing (AMB) ceramic substrates.

Technical Comparison:

- Conventional Alumina (Al₂O₃)/Aluminum Nitride (AlN): While AlN offers high thermal conductivity (170 W/mK), its mechanical strength is inferior (flexural strength ~350 MPa) with high brittleness. Under electric vehicle thermal cycling (thermal shock), copper layer delamination or ceramic cracking readily occurs.

- Silicon Nitride (Si₃N₄): Though thermal conductivity (90 W/mK) is somewhat lower than AlN, flexural strength reaches 700 MPa—nearly double AlN’s fracture toughness. This enables Si₃N₄ substrates to be manufactured thinner (typical 360μm versus AlN’s 630μm), achieving thermal resistance comparable to AlN in practical applications while delivering substantially superior mechanical reliability.

Measured Data:

BASiC Semiconductor test data demonstrates that after 1000 thermal shock cycles, conventional Al₂O₃/AlN substrates exhibited obvious delamination phenomena, while Si₃N₄ substrates maintained excellent bonding strength. This high-reliability packaging technology application eliminates supply chain concerns about Chinese modules’ “short lifespan.”

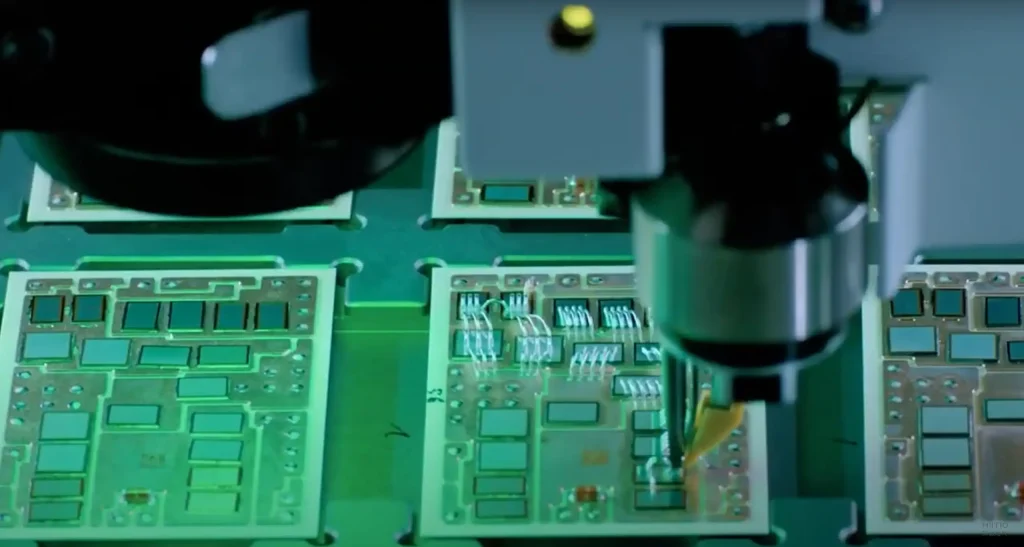

3.2 Static Parameter Benchmarking Validation

In specific parameter benchmarking, Chinese modules now compete on equal footing. Comparing BASiC Semiconductor’s BMF540R12KA3 with leading international manufacturer CREE’s equivalent product (CAB530M12BM3):

- On-Resistance (R_DS(on)): At 150°C elevated temperature, Chinese module upper/lower bridge arm resistances measure 3.86 mΩ/3.63 mΩ, respectively, matching international competitors (3.53 mΩ/3.67 mΩ).

- Body Diode Forward Voltage (V_SD): Chinese modules’ diode conduction voltage at elevated temperature (4.36V) actually outperforms competitors (5.49V), meaning lower freewheeling losses during dead time.

Chapter 4: Conclusion

Chinese power electronics enterprises’ comprehensive push to replace imported IGBT modules with Chinese SiC modules represents the resonance of technical dividends with industry consensus.

From a technical logic perspective, SiC’s wide bandgap characteristics deliver low losses, high frequency, and high-temperature tolerance advantages that overcome IGBT’s physical bottlenecks in new energy and high-efficiency applications. Particularly, Chinese manufacturers’ breakthroughs in Si₃N₄ AMB packaging and supporting drive technologies have resolved reliability and usability challenges, making “replacement” technically viable.

From a commercial logic perspective, while device unit prices remain elevated, system BOM cost reductions (battery, thermal management, magnetics) combined with full-lifecycle energy efficiency benefits (OPEX) provide SiC solutions with exceptional cost-performance ratios. More critically, explosive capacity and price competition in China’s SiC industrial chain are rapidly closing the price gap with silicon-based devices.

From a strategic logic perspective, facing uncertain international environments, supply chain security transcends purely commercial considerations. Constructing a completely autonomous and controllable “Chinese supply chain” from materials and chips through modules represents the survival baseline for all leading Chinese power electronics enterprises.

In summary, this replacement process represents not merely product iteration but a historic leap for China’s power electronics industry from “follower” to “leader.”

Accelerate Your Power Electronics Transformation with HIITIO

As the industry pivots toward SiC technology, selecting the right partner becomes critical for success. HIITIO stands at the forefront of China’s power electronics revolution, offering industry-leading SiC power modules engineered for reliability, performance, and cost-effectiveness. Our comprehensive product portfolio—spanning energy storage systems, EV charging infrastructure, and industrial power solutions—leverages cutting-edge Si₃N₄ AMB packaging technology and proven thermal management innovations. With vertically integrated manufacturing capabilities and commitment to quality excellence, HIITIO delivers the technical advantages and supply chain security your business demands. Contact our technical team today to discover how HIITIO’s SiC solutions can optimize your system efficiency, reduce total ownership costs, and future-proof your competitive position in the rapidly evolving power electronics landscape.

Appendix: Core Data Tables

Table 1: Key Performance Comparison Between SiC MOSFET and Si IGBT

| Performance Metric | Si IGBT Module | Chinese SiC MOSFET Module (e.g., BMF540R12MZA3) | Technical Impact |

|---|---|---|---|

| Conduction Mechanism | Bipolar (minority carrier injection) | Unipolar (majority carrier conduction) | SiC eliminates tail current, enabling ultra-fast turn-off |

| Voltage Drop Characteristics | V_CE(sat) (fixed threshold ~1.5V) | I_D × R_DS(on) (linear resistance) | SiC delivers superior efficiency under light loads |

| Switching Losses | High (tail current influence) | Extremely low (primarily gate-drive limited) | Enables 4× frequency increase or greater |

| Reverse Recovery | Requires parallel FRD, large Q_rr | Body diode with minimal Q_rr | Reduces shoot-through risk and EMI |

| Operating Junction Temperature | Typically 150°C | Achieves 175°C and above | Increases power density, simplifies thermal management |